The trouble with Amazon aggregators: a lesson in eComm financing

Simon O'Sullivan

November 28, 2023

News

A tale of misplaced optimism

If you’re as invested in eCommerce as we are, you’re probably reading a lot of articles at the moment about eCommerce behemoths, that you’d never heard of before, which are teetering on the brink of bankruptcy. During the pandemic, we watched the rise of companies like Thrasio, Razor Group, and Perch with intrigue. Wall Street banks and venture capital firms were pumping millions into these enterprises, inflating their value and fuelling a furious period of mergers and acquisitions between them.

Numerous similar companies approached us for financing in the last number of years but we passed on most of them as their viability raised some red flags. The same cannot be said of venture capital and debt firms who invested an estimated $16 billion in these businesses between 2020 and 2023 and are now left holding the can. For that reason, it makes Amazon aggregators the perfect case study in how the evaluation criteria of traditional lenders is flawed and how we at Wayflyer do it differently.

The Amazon aggregator boom

Before I go on, let me quickly explain Amazon aggregators and the nature of their business. They’re like the Pac-Men of the eCommerce universe, hungrily gobbling up as many successful small brands on Amazon as possible, from foot massagers to trendy air purifiers. The logic was that they could achieve huge economies of scale in terms of R&D, marketing, and back-office operations and consolidating the supply-chain of the shipments of these products from China. They aspired to be the next Unilever or Procter & Gamble, by consolidating hundreds of small sellers under one giant umbrella. It was all about turning these fragmented sellers into a cohesive, money-making machine. In theory, brilliant; in practice, well, that's another story.

The pandemic was the green light aggregators had been waiting for. The world turned to online shopping, people filled the time they usually spent commuting and socializing with adding items to their cart. As small brands of teeth whitening devices and beard tamers struggled to keep up with the new demand for their products, aggregators swooped in, snapping up brands left and right. At its height, Thrasio was acquiring 3 businesses a week, earning profits of $100m on sales of $500m.

Aggregators became the golden children of investors and the scene became more crowded than a Black Friday sale. Ninety-nine active players collectively raked in a staggering $15 billion in funding. Thrasio, once the lone wolf in this game, found itself in a packed party. Enter Perch, strutting in with a cool $755 million from a Series A round, courtesy of SoftBank's Vision Fund 2 in 2021. Not to be outdone, Berlin Brands Group joined the billionaire's club with a $700 million funding round, skyrocketing its valuation beyond the billion-dollar mark. Thrasio became one of the fastest growing unicorns on record.

The inevitable fall

2022 brought the party to a screeching halt. Interest rates started rising and shoppers decided they missed the charm of brick-and-mortar stores, and wanted to spend their money on travel and activities rather than things, leaving eCommerce growth to plateau. Revenues started to fall YoY and profitability slumped. Adding to the agony, Amazon decided to hike seller fees by over 30% since 2020. The high-powered aggregator executives, who seemed to be spending most of their time on the podcast circuits talking about their morning routines, were clueless about how to turn the situation around.

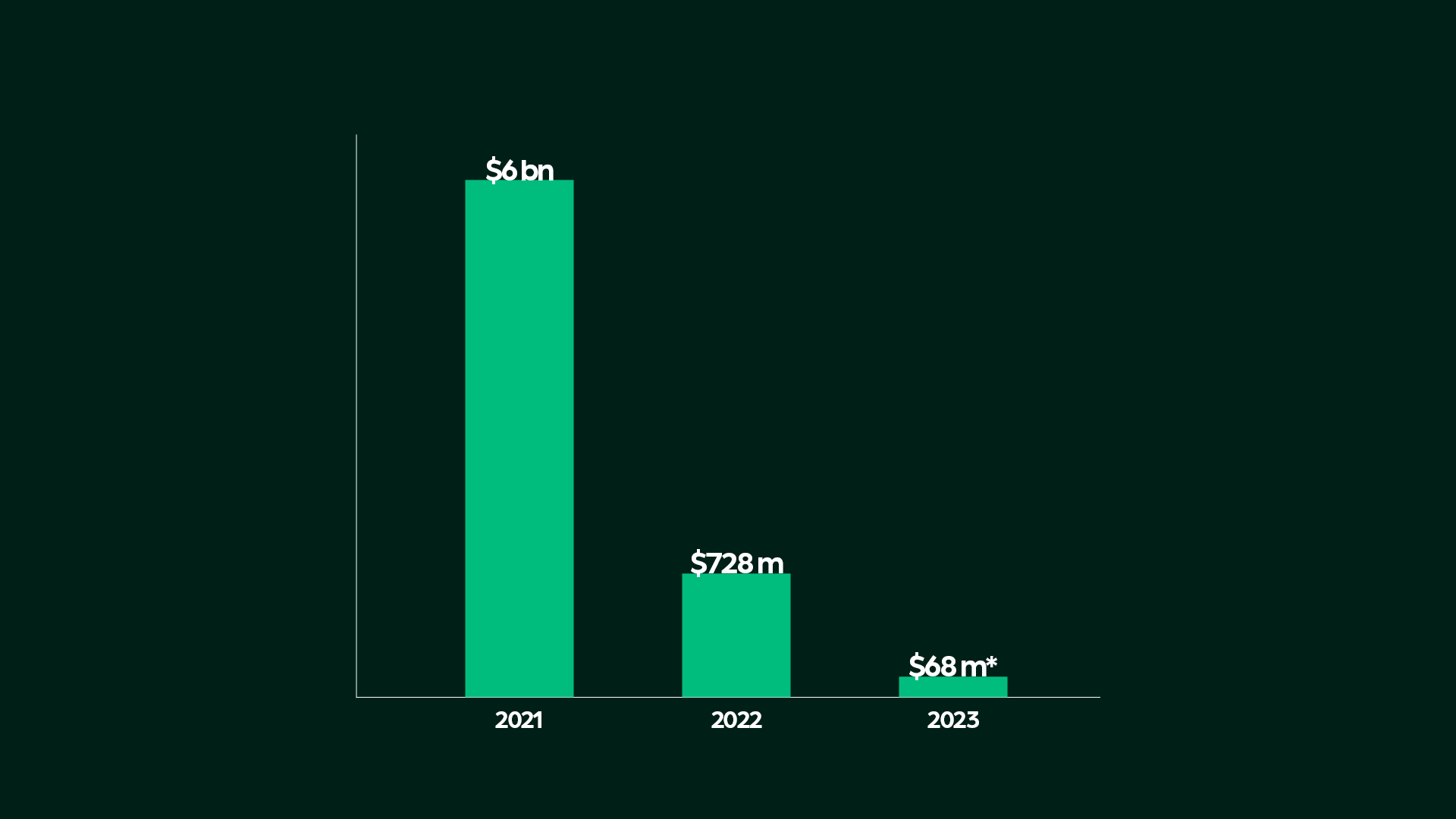

Aggregators started cutting costs like a budget-conscious pirate. Layoffs, mergers, you name it – aggregators were doing anything to keep the ship afloat. The investor enthusiasm that once flooded the sector dried up. We're talking a plunge from over $6 billion in investments in 2021 to a mere $728 million in 2022. And in 2023? A paltry $68 million by May.

The majority of aggregators were run by dealmakers rather than online sellers. Juozas Kaziukėnas put it really well when he wrote: “Macro issues aside, some aggregators turned out to be worse at being Amazon sellers than the Amazon sellers they acquired.” Turns out, throwing money at a problem isn't always the solution. Operational skills trump M&A experience in this game. With sales shrinking and reality setting in, the once-booming sector started looking like a scene from a financial horror movie.

Flawed evaluation criteria

Investors, giddy with the online sales boom, miscalculated its permanence. They saw the pandemic’s eCommerce surge as the new normal, ignoring the temporary boost from government supports and the fact that people, frankly, had nothing better to splurge on.

These investment bankers, with their spreadsheets and forecasts, envisioned a future of relentless growth, flatlining operational expenses, and ever-broadening margins. Their models promised landslides of profits and justified the huge sums spent on acquisitions. It seemed foolproof, but they overlooked a crucial element: the customer.

They forgot that at the end of the day, it’s Amazon’s playground, not theirs. They didn’t own the buy box, nor did they have any say over the seller fees. And, the essence of the original brands, solving a customer’s problem, was lost in translation. These brands, once so closely attuned to their customers’ needs, became mere cogs in a larger, impersonal machine under the aggregators. The human voice, the understanding of their customers, was drowned out in a sea of balance sheets and market projections.

The fate of the key players

So where are they now? The standing of the aggregators and their investors does not make for pleasant reading. Victory Park Capital, with its hefty $775 million backing of Perch, is in a tight spot as it struggles to offload this once-celebrated aggregator. It's like Cinderella's carriage turning back into a pumpkin – except these pumpkins are saddled with debt and diminishing returns.

Despite having a $325 million cushion from its Series A round, New York based Benitago waved the white flag, filing for Chapter 11 bankruptcy. It's a classic case of “too much, too soon”, overbuying at market peaks and drowning in debt as interest rates skyrocket.

Meanwhile, other aggregators are busy playing musical chairs. Berlin-based SellerX scooped up Austin's Elevate Brands, while Suma and D1 Brands merged into The Ambr Group. Then there's the case of Thrasio, the poster child of Amazon aggregators, now preparing for bankruptcy. With online spending dipping post-pandemic, Thrasio found itself recalibrating expectations, laying off staff, and staring down the barrel of financial restructuring.

But even those still standing, trading reasonably well, find themselves in a bind. Saddled with hefty debt facilities now overshadowing their worth, management and venture partners are trapped in a loveless marriage.

eCommerce has a huge allure due to its lower barriers to entry compared to other ventures. However, the barriers to exit are equally low. Our philosophy at Wayflyer has always been to build with what you have, focus on the bottom line, and avoid burdening the business with excessive debt. In the world of Amazon aggregators, overpaying for brands, piling on debt, and banking on perpetual growth was a recipe for disaster. As the industry faces a reckoning, it's clear that only those with flawless execution and distinctive products will survive this shakeout.

The Wayflyer approach to funding

At Wayflyer, we chose a different path from the outset. We use live data to assess a business instead of the months-old financial statements beloved by banks. Our revenue-based financing model isn’t just about crunching numbers; it's about understanding the market, the consumer, and the real potential behind each business.

We also funnel bank transactions through our in-house system, giving us a crystal-clear picture of a company's true profitability on an ongoing basis. By interacting with a plethora of brands, we've got our finger on the pulse of the market. We can contextualize a customer's performance with laser precision, unlike the traditional approach that leans on outdated, aggregated industry info.

Take underperformance, for example. While some might blame a market downturn in a specific vertical, we often see other companies in the same space thriving. It's this nuanced, real-time analysis that sets us apart and has validated our approach time and again. Take, for example, our work with Bubblebum. We saw their potential where others saw just numbers, and by leveraging our unique insights, we fuelled their growth in ways traditional models never could.

Learnings from the aggregator saga

The rise and fall of Amazon aggregators isn't just a tale of failure. It's a lesson in valuation and brand equity. The key takeaway? It's not that the business model of aggregators is inherently flawed. The real misstep was in the sky-high valuations slapped on these companies circa 2020.You can successfully grow by adding brands to your portfolio, but do it at a reasonable cost. Why? Because an Amazon brand doesn't carry the same brand value as having your own store. Take True Classic versus a generic T-shirt on Amazon – the difference is in brand recognition. When you shop from a dedicated website, you connect with the brand. On Amazon, that connection is often missing. This distinction is crucial in understanding the aggregator model's potential and pitfalls.

The future of eCommerce funding

The saga of the Amazon aggregators serves as a crucial lesson. For eCommerce founders and CFOs, take heed: The post-COVID world hasn't altered the fundamentals. It's time to refocus on unit economics and scale efficiently.

During the pandemic, many were dazzled by unprecedented growth and lost sight of these core principles. As we move forward, Wayflyer's commitment is to foster a funding landscape that emphasizes smart, sustainable growth. We champion a return to basics, ensuring that every financial decision is grounded in solid economics and prudent scaling strategies. This is the path to thriving in the ever-evolving world of eCommerce.